The Single Strategy To Use For What Is Trade Credit Insurance

Wiki Article

What Does What Is Trade Credit Insurance Mean?

Table of ContentsSome Known Details About What Is Trade Credit Insurance The 4-Minute Rule for What Is Trade Credit InsuranceWhat Is Trade Credit Insurance Things To Know Before You Get ThisThe smart Trick of What Is Trade Credit Insurance That Nobody is Talking AboutThe 25-Second Trick For What Is Trade Credit Insurance

ECI, the expense of which is commonly integrated into the marketing cost by merchants, should be a positive purchase, in that exporters should obtain insurance coverage before a customer comes to be an issue. ECI policies are supplied by numerous private industrial risk insurer as well as the Export-Import Financial Institution of the United States (EXIM), the federal government company that aids in financing the export of united state

For a lot more on credit score insurance coverage, see the EXIM web site.

The Buzz on What Is Trade Credit Insurance

Profession Credit score Insurance coverage provides accessibility to information held by insurance companies about the economic health of firms you are planning to do service with. Insurance providers can share this details with their insurance policy holders. Your consumers have a vested rate of interest in guaranteeing their suppliers can acquire profession credit score insurance and also offer information of their up to date trading task to the insurers.

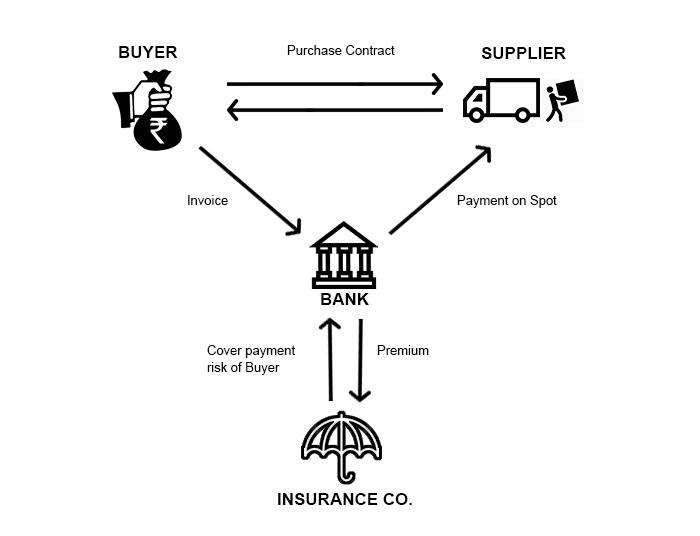

If you are thinking about making use of invoice financing, profession credit scores insurance policy can provide your finance business with the protection they require to offer extra financing. Making Use Of Trade Credit report Insurance policy to offer clients as well as leads extra favourable credit score payment terms as well as limitations. This might have a substantial effect on your sales performance.

While we have no recognized link to Julie Andrews, below at The Network Collaboration our company believe in being familiar with our client. Most importantly, please do not believe we just 'use' profession credit history insurance policy. Our solution surpasses that also if you select not to collaborate with us at the end of the day.

The Ultimate Guide To What Is Trade Credit Insurance

Or, if we think that credit report insurance isn't ideal for your service, then we'll be truthful and put in the time to describe why we think this is and also information alternative choices we believe it's the right point to do. We value our people that are the backbone to what we do, and this is shown in the service that we provide to our consumers.For a lot of businesses, the worth of the debtor's journal, the cash you are owed, is one of the biggest possessions and also yet it is commonly not insured. The majority of companies ensure various other vital possessions readily, yet the danger to a service of customer insolvency can check be among one find this of the most unpredictable direct exposures.

Unless you require payment ahead of time or are covered by credit insurance policy, this makes you vulnerable to poor financial debt (What is trade credit insurance). Ask yourself, what would be the effect of among your largest customers stopping working to pay you? Any kind of business selling products and also solutions on credit scores terms with direct exposures to uncollectable loans ought to strongly think about profession credit insurance as part of their service threat approach.

Profession Credit scores Insurance coverage is heavily utilized in the Structure as well as Building and construction field and also utilized by businesses of all sizes with minimum annual turnover usually beginning around $750,000 upwards. There is no 'one dimension fits all' strategy when it comes to Profession Credit rating Insurance and the level and price of your plan will certainly be dictated by your demands.

What Is Trade Credit Insurance - Questions

For 2 years company has actually been battered. We have a large selection of products assured to guarantee your organization against the unpredicted; find out which one functions for you.Our main focus is to be the leading Profession Credit scores, Insurance in addition to Guaranty & Bonds services carrier, by supporting our clients' expanding need throughout, Africa. Obtain an informative, inside view trade credit insurance coverage with our try this site most recent news as well as updates.

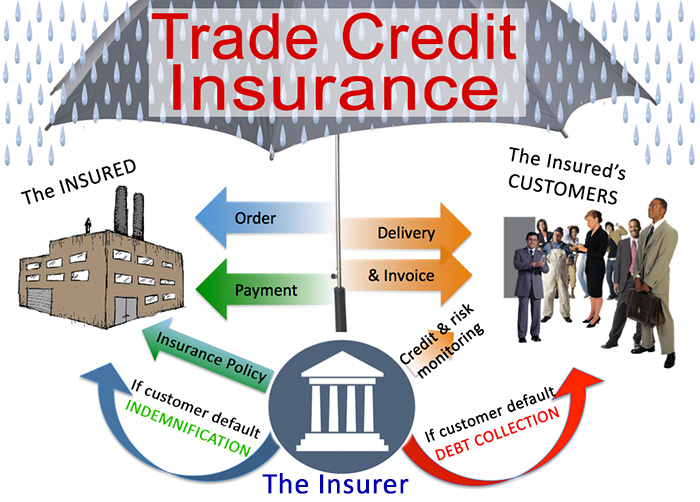

Trade credit insurance is a method of safeguarding your balance dues (invoices) from non repayment. It is a progressively prominent kind of protection versus consumers which either reject to, or can not, pay their financial debts. What is trade credit insurance. Allow's figure out just how it works Material Trade credit history insurance, occasionally called 'uncollectable loan defense', is an insurance coverage cover for organizations versus clients who don't pay their debts.

It can be made use of as a standalone item covering the entire company accounts receivable; as a screw on for billing financing; or to cover a particular portion of a firm's billings, as an example those from exports only. Profession credit rating insurance is currently a prominent field with various options tailored to various sections of the market.

Some Ideas on What Is Trade Credit Insurance You Should Know

Underwriters use what are called actuarial strategies (statistical analysis of risk in insurance coverage) to look at the market of profession, the credit rating of the firms involved, previous uncollectable loan experience and a variety of various other factors. Based on this analysis, the expert will develop a credit rating restriction for each and every company to which the credit insurance coverage will use.In some circumstances this may not cover the total amount of the profession yet a portion just. Along with its basic protection, debt insurance has the added value of using understanding right into the credit-worthiness of your consumers (What is trade credit insurance). This may allow you to make smarter tactical decisions as you grow business.

Report this wiki page